Global Equity Markets in Flux: Unraveling the Post Pandemic Realities in India, EU, and USA

By: Saachi Sahni

BSc Maths Hons-Jesus & Mary College, University of Delhi

1. Abstract:

This research delves into the intricate dynamics of the post-pandemic impact on the stock markets of India, the European Union, and the United States. The study also emphasizes the heightened integration of global equity markets, anticipating a more robust correlation among the stock prices of companies worldwide, thereby fostering economic convergence across diverse economies. Recognizing the pivotal role of financial markets, particularly stock markets, as major determinants of a nation’s financial and economic performance, the research navigates through the versatile yet equally risky terrain of equity markets.

While a nation encompasses various markets such as product and factor markets, the equity market stands out as the most pivotal, operating on the mechanism of shareholding in diverse companies. Unlike markets focused on manufacturing, transportation, and the exchange of products, the stock market relies not only on the principles of demand and supply but is equally influenced by a myriad of social, political, geographical, and economic factors.

For instance, the hypothetical scenario of a founder’s fatal accident at a company like Apple can trigger significant movements in its share prices, irrespective of the company’s product features, performance, or overall standing.

Highlighting the inherent volatility of stock markets transcending national borders, the research underscores the susceptibility of these markets to external shocks. The recent global upheaval caused by the COVID-19 pandemic serves as a poignant example, affecting stock markets worldwide. No nation, regardless of its economic prowess, could evade or control the far-reaching implications of the pandemic. Instead, countries strategically maneuvered to implement solutions and navigate the storm, aiming to minimize the traumatic effects on their respective stock markets.

This paper aims to provide a comprehensive understanding of the complex interplay of factors influencing stock markets in the wake of global crises, shedding light on the strategies employed by nations to mitigate economic disruptions. Through a nuanced exploration of these issues, the research contributes to the broader discourse on the resilience and adaptability of financial markets in the face of unprecedented challenges.

2. Introduction:

In the words of the astute American publisher and author, William Feather, the stock market manifests a peculiar dynamic where every buyer believes in their astuteness as they transact with another individual convinced of the same. Today, a surge in individual participation within financial markets is observable, fueled by the proliferation of financial products and services. Concurrently, structural reforms and liberalization initiatives often instigate a power oscillation between private institutions and investors. However, amidst this financial landscape, a concerning observation emerges – a lack of financial literacy among investors.

While basic financial terminologies such as inflation, interest, compounding, and returns are commonplace, a significant portion of investors seldom delves deeper. Understanding the distinctions between bonds and stocks or mastering the basics of risk diversification remains elusive for many. This dearth of financial knowledge substantially compromises decision-making capacities, particularly in the perilous domain of the equity market. In response, researchers and seasoned individuals offer predictions not only as a means to curtail losses but also to pursue lucrative yet inherently uncertain profits.

The evolution of stock markets, marked by their inception, reveals a consistent theme evident in numerous research studies. The global stage witnesses a recurrent pattern- when a global issue arises, losses reverberate across nations, impacting a majority of them.

However, a stark disparity emerges in the aftermath: developed countries bear less enduring scars compared to their developing and underdeveloped counterparts. The vulnerability of the latter lies in their fragile economies, rendering them defenseless against the onslaught of global challenges, leaving them economically devastated.

As the world reopens its boundaries post the seismic disruption caused by the COVID-19 pandemic, a collective realization unfolds. Nations, regardless of their economic stature, confront analogous challenges, albeit at varying intensities. Their diverse responses to these challenges reveal not only the resilience but also the adaptive strategies employed to navigate the intricate aftermath of a global crisis. This research embarks on a comprehensive exploration of the post-pandemic trajectory of stock markets in India, the European Union, and the United States, dissecting the shared challenges and distinctive approaches that define the recovery landscape.

In this paper we will be discussing the histories, the general conditions as well as the post pandemic conditions of the stock markets and steps taken to serve the issues in detail by:

1. India

2. United States of America

3. European Union

3. India – Navigating Through Historical Swings and Pandemic Challenges:

The history of the Indian stock market travels way back to the times of British Rule in the 18th century where the East India Company started trading in cotton and bank loans in Mumbai during 1830s but trading in stocks and securities kick started in the 1850s opposite the town hall under a banyan tree in Bombay itself but kept on shifting as the number of brokers and investors kept on increasing and by 1874 it settled in the Dalal Street. In India other than NSE-National Stock Exchange and BSE-Bombay Stock Exchange with 22 more small and big regional stock exchanges that were birthed in Ahmedabad, Vadodara, Banglore, Bhubaneshwar, Mumbai, Kolkata, Ludhiana, Chennai, Mangalore, Meerut, Patna, Pune and Rajkot which came into existence one by one starting with The Native Share and Stock Brokers Association which happens to be the predecessor of BSE in 1875 and BSE got recognized in 1957 by the Government of India. In 1894, The Ahmedabad Stock Exchange which mainly carried out the trading of textile companies was born. Consequently, in 1904 Calcutta Stock Exchange formed which traded in jute and rice plantations. Post Independence, the SEBI-Securities Exchange Board of India was formed in 1988 and by 1992 it became an autonomous body which had the rights to control the trading of all securities across India moreover birthed NSE in order to create competition in the market for BSE and increase the transparency of transactions.

At present there are 7 recognized stock exchanges namely- Calcutta Stock Exchange Ltd., Magadh Stock Exchange Ltd., Metropolitan Stock Exchange of India Ltd., India International Exchange & NSE IFSC Ltd.

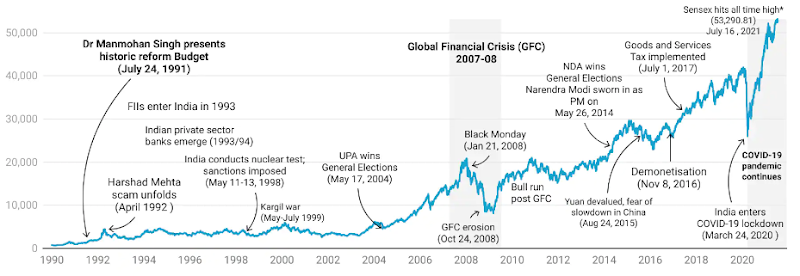

The period 1990-2000s was the time when India opened its boundaries to other countries and stepped into the era of liberalization. With the opening of the Indian Economy, major changes were witnessed in the Indian Capital Market. The stock market experienced unprecedented swings and volatility during this period, which have had severe repercussions for investors, both individual and institutional. In six months from March to September 1990 BSE rose from 774 to 1260 which is almost an increase of 60% and like that in one swift surge, the barrier was broken. There’s been no stopping since then. Indian stock markets have grown significantly in terms of market capitalization and market turnover ratio. As per Standard & Poor’s Global Stock Markets Fact book (2011), India ranked 7th in terms of market capitalization (11th in 2009), 10th in terms of total value traded in stock exchanges, and 22nd in terms of turnover ratio, December 2010. The market capitalization in Indian stock markets has grown over the period, indicating that more companies are using the trading platform of the stock exchange. The market capitalization across India was around Rs. 68,430,493 million at the end of March 2011. During 2010, turnover of Indian stock exchanges in the cash segment increased 43.3 percent to Rs. 55,184.7 billion from Rs. 38,525.8 billion in 2009. The Bombay Stock Exchange 3 (BSE) and National Stock Exchange (NSE) together contributed 99.9 percent of the turnover. Of this, the NSE accounted for 74.9 percent of the total turnover in the cash market whereas the BSE accounted for 24.9 percent to the total. But the situation did not stay the same for long, it had its major slowdowns and breaks. In 1992 Harshad Mehta Scam took place due to which NIFTY fell from 4500 to 2500 points, it was a total scam of 5000 crores which at that time was more than the combined central budget of health and education for the whole country hence major losses were experienced to an extent that aftershocks are still felt though rarely.The Kargil War in 1999 too scarred the market. Between 2004-2006 BSE alone fell by more than 15% which is termed as the biggest fall in the history of India. On 21st January 2008 the BSE stopped trading at 2:30 due to technical issues which turned out to be so disastrous that, that day has been referred to as the ‘Black Monday’.SENSEX fell by 2200+ points and managed to revive at a loss of 875 points similarly NIFTY too closed at a loss of 300 points. Demonetization in 2016 by the ruling government and issues with China over crude oil prices also had a temporary yet triggering effect.

With a couple of years of normal and controllable market movements,2018 again came with a storm yet short lived where SENSEX and NIFTY fell by 600 and 400 points respectively.

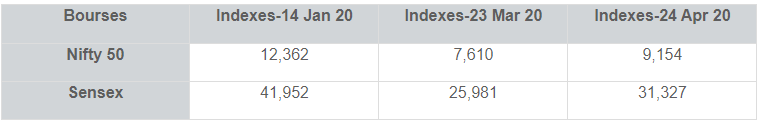

Above all the biggest turmoil was still waiting not only for India but the whole world vis-à-vis the spread of the COVID-19 Virus which created havoc and was being termed as the pandemic by WHO-World Health Organization in no time. In the beginning of the pandemic NIFTY & SENSEX were hitting there all time high at 12,362 and 42,275 respectively and unfortunately the the pandemic was highly unpredictable to an extent that NIFTY & SENSEX fell by 39% in no time causing an overall loss of more than quarter of the Indian Market leaving it all shredded. The pandemic is often referred as the ‘Black Swan’ for the Indian Market.

Such gloomy state of the Indian Market had not been witnessed since the Global Financial Crisis of 2008.COVID-19 didn’t only come as something which would affect the health but even lead to long quarantines and curfews which derailed not only a couple of companies but the complete industries going down the hill. The tourism, hospitality, retail, entertainment and construction industries were the ones who suffered the most and dipped by more than 40% whereas on the other hand health, pharmaceutical and technologically driven industries were all time high.

As a result The Government of India along with Reserve Bank of India (RBI) came up with solutions such as decreasing the repo rate and providing easy loans but this resulted in a more sluggish economy that being helpful as the number of bad loans granted on the basis of the asymmetric information provided increased instead of catering the genuine need of credit.

While the crisis was real but historically, such a crisis did not last long as India is gradually becoming competent enough to use its present resources in the best of ways to combat these challenges. Despite the fact that it is certain that the markets often bounce back soon after the crisis gets over. With a CAGR of approximately 15 percent, Sensex grew from 100 points in 1979 to over 41,000 points in 2019, Indian Markets have proved time and again that corrections are temporary, but growth is permanent.

4. European Union – Diverse Markets, Common Goals:

The European Union (EU), a consortium of 27 member countries and characterized by shared political, social, economic, and financial objectives. Its member nations include Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Sweden. Notably, the United Kingdom, although originally one of the founding members, chose to exit the EU in 2020 through the Brexit Agreement. This decision aimed to secure autonomy in shaping immigration policies, establishing regulations, and managing its economy independently.

Turning our attention to the financial landscape within the European Union, it is essential to acknowledge the diversity of stock exchanges that operate independently in each member country. These exchanges play a crucial role in shaping the economic narratives and investment climates of their respective nations.

The key stock exchanges within the EU include:

- Vienna Stock Exchange: Serving as the primary securities exchange in Austria, it contributes to the country’s financial infrastructure.

- Bulgarian Stock Exchange: An influential financial platform in Bulgaria, facilitating the trading of securities and fostering economic growth.

- Cyprus Stock Exchange: A significant player in Cyprus, contributing to the nation’s economic development through efficient financial transactions.

- Berlin Stock Exchange: A key financial institution in Germany, playing a crucial role in the nation’s economic development and global financial interactions.

- Frankfurt Stock Exchange: One of the world’s largest stock exchanges, it holds immense significance for Germany and the global financial community.

- Athens Stock Exchange: Operating in Greece, it is a cornerstone of the nation’s financial infrastructure, connecting investors with diverse opportunities.

- Budapest Stock Exchange: Serving Hungary, it acts as a pivotal platform for trading securities, influencing the country’s economic dynamics.

- Warsaw Stock Exchange: A significant financial institution in Poland, facilitating the trading of securities and contributing to economic progress.

- Madrid Stock Exchange: A major financial hub in Spain, contributing significantly to the economic development and global financial interactions.

- Stock Exchange of Barcelona: A key player in Spain, it facilitates the exchange of securities and plays a crucial role in the nation’s financial landscape.

These independent stock exchanges collectively contribute to the economic vibrancy of their respective countries and, collectively, form a complex yet interconnected financial network within the European Union. The diverse range of exchanges reflects the rich economic tapestry of the EU, where each member nation actively participates in the global financial arena.

In the realm of European financial markets, amidst the multitude of national exchanges, two prominent pan-European exchanges emerge, each wielding substantial influence and contributing significantly to the continent’s economic tapestry.

Euronext:

Euronext, a powerhouse in the European financial ecosystem, operates across seven major economies – Amsterdam, Brussels, Dublin, Lisbon, Milan, Oslo, and Paris. Its inception in 2000 marked the amalgamation of the Amsterdam Stock Exchange, Brussels Stock Exchange, and Paris Bourse. Euronext swiftly ascended to prominence, culminating in its Initial Public Offering (IPO) in 2001, transforming it into one of the most valuable and powerful exchanges globally.

This financial giant boasts a portfolio of over 500 international indices and is the creator of the Euronext CAC 40 ESG Index, reflecting its commitment to environmental, social, and governance considerations. Operating electronically, Euronext utilizes cutting-edge trading platforms to seamlessly match buy and sell orders. With a colossal investment base of 6 trillion Euros, over 350 trading members, and a global investor community exceeding 6,000, Euronext stands as a beacon in the financial landscape.

The strategic addition of the London International Financial Futures and Options Exchange (LIFFE) and the Portuguese stock exchange, Bolsa de Valores de Lisboa e Porto (BVLP), in 2001 and 2002, played a pivotal role in Euronext’s expansion, proving beneficial to the broader economy. Positioned in Europe among developed countries, Euronext experiences relatively low market volatility and risk, making it an attractive and reliable investment destination. However, prudent consideration is advised in currency investment and hedging decisions, particularly focusing on Eurozone indexes to navigate unexpected movements with heightened intensity that may lead to adverse returns and substantial losses.

Nasdaq Nordic:

Venturing into the Baltic areas of Europe, Nasdaq Nordic operates seamlessly across exchanges in Copenhagen, Stockholm, Helsinki, Iceland, Tallinn, Riga, and Vilnius. Established in 1971 by the National Association of Securities Dealers (NASD), now recognized as FINRA (Financial Industry Regulatory Authority), Nasdaq Nordic has been a trailblazer in electronic trading, revolutionizing traditional floor trading practices. This exchange operates entirely electronically,

Employing sophisticated computerized systems to match buyers and sellers. The electronic trading model not only ensures faster execution of trades but also enhances liquidity in the market. Nasdaq Nordic has emerged as a global hub for innovation, hosting major companies like Apple, Microsoft, Google, and more.

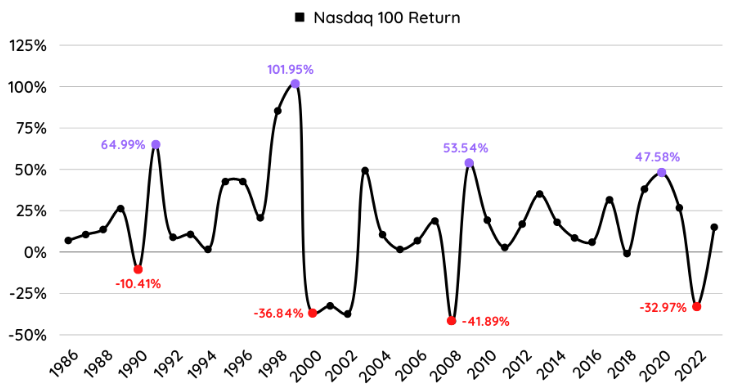

Its composite index, tracking the performance of all listed companies, and the Nasdaq-100 Index, comprising the largest 100 non-financial companies, are key indicators of broader stock market and technology sector performance. The cumulative return of Nasdaq, exceeding 15,214.71% with dividends reinvested, underscores its pivotal role in the global financial ecosystem. Investors closely monitor Nasdaq indexes and the performance of its listed companies, considering them as reliable benchmarks for evaluating broader market dynamics and the technology sector’s health. NASDAQ comprises of firstly the Composite Index which tracks the performance of all the listed companies. Secondly we have 100 Index which has the largest 100 non-financial companies listed in NASDAQ. Third stands as Capital Market which is meant for newbie and emerging companies. Fourth we have the Global Market which includes all the companies which have higher corporate and financial governance standards and we also have Global Select Market which is reserved for the companies who have the highest governance standards. It is a hub for innovation and home to big companies like Apple, Microsoft, Google and many more. NASDAQ provides market data feeds, trading technology, and other services to financial institutions and exchanges globally. The U.S. Securities and Exchange Commission (SEC) regulates the NASDAQ to ensure fair and transparent trading practices. NASDAQ often experiences higher levels of volatility compared to other exchanges because it mainly focuses on growth related stocks which plays a crucial role in the global financial ecosystem. NASDAQ often hosts innovative companies from sectors like technology, biotechnology, and renewable energy.

It has been at the forefront of listings for special purpose acquisition companies (SPACs) and crypto currency-related companies. Investors often track NASDAQ indexes and the performance of NASDAQ-listed companies as an indicator of the broader stock market and technology sector performance. The Cumulative return of NASDAQ has been over 15,214.71% with dividends reinvested. This means If a person had invested $100 in January 1985, the investor’s portfolio would have grown to over $15,214 by the end of January 2023.

5. United States of America – A Historical Odyssey of Market Evolution:

The historical trajectory of the U.S. stock market is a captivating narrative that unfolds across centuries, mirroring the evolution of global finance. Rooted in the early 17th-century stock markets of Europe, the emergence of the inaugural stock market in Amsterdam in 1611 set the stage for what would eventually become a defining aspect of economic landscapes worldwide. While Europe laid the initial foundation, the United States entered the scene later, making a significant impact on the financial stage.

The U.S. financial journey commenced with the birth of the Philadelphia Stock Exchange in 1790, and it was the iconic Buttonwood Tree Agreement of 1792 that marked a turning point, leading to the establishment of the New York Stock Exchange (NYSE). This monumental development became the bedrock of the U.S. stock market, solidifying its role in the global financial arena. The 19th and 20th centuries were pivotal periods marked by a series of stock market crashes, each leaving an indelible mark on the evolution of the U.S. financial system. From the Panic of 1819 to the Knickerbocker Crisis in 1907, these events shaped the regulatory landscape and prompted transformative changes. The cataclysmic 1929 stock market crash led to the establishment of the U.S. Securities and Exchange Commission (SEC) with a clear mandate – to regulate and ensure fair and transparent trading practices. The subsequent decades witnessed a technological revolution that reshaped stock exchanges. In 1971, NASDAQ pioneered electronic trading, ushering in a new era and revolutionizing traditional floor trading practices. This technological leap laid the foundation for increased efficiency, speed, and accessibility in financial markets. The resilience of the U.S. stock market was tested during times of adversity, notably with the Dotcom Bubble in the late 1990s and the seismic shockwaves of the 2008 Global Financial Crisis. These challenges showcased the market’s mettle, and the rebound that followed affirmed its enduring strength and adaptability to changing circumstances.

In recent years, the U.S. stock market has experienced unprecedented growth, with major indices such as the S&P 500 reaching historic highs. The dynamic economic landscape, characterized by innovation and entrepreneurial spirit, has propelled exchanges like NASDAQ to the forefront. Renowned for its emphasis on growth-related stocks, NASDAQ has become a symbol of technological and economic prowess. The historical tapestry of the U.S. stock market is woven with threads of both adversity and triumph, embodying the nation’s economic resilience. Positioned as a global barometer of economic health, the U.S. market’s adaptability solidifies its role as a cornerstone of the global financial system. Investors worldwide continue to turn their gaze to the U.S., where the market’s proven resilience and capacity to navigate uncertainties underscore its pivotal role in shaping the narrative of global finance.

6. Post Pandemic Situation in India, EU, and USA:

History demonstrates that occasionally, unforeseen or unimaginable events transpire. These occurrences catch everyone off guard, causing widespread disruption and chaos in human affairs, significantly impacting human life. These unpredictable events are commonly referred to as black swans. The origin of this term dates back to 1697 when the prevailing belief was that all swans were white. This perception changed when Dutch explorers discovered black swans in Western Australia, challenging the previously held assumption. The advent of the novel coronavirus (COVID-19) and its impact on the stock market exemplify a classic black swan event. The global stock market experienced a significant decline amid the emergence of Covid-19, leading to a worldwide standstill, including the business sector. Markets globally plummeted to levels not witnessed since the financial crisis of 2008. While the world has encountered market crashes in the past, the impact of Covid-19 is notably distinct due to the widespread nature of the pandemic, contributing to heightened uncertainty in the market. The country underwent a complete lockdown lasting nearly three months, adversely affecting various economic activities.

While studying about India, In tandem with the trends and indices of the global market, Nifty 50 witnessed a substantial 38% decline. The overall Market Capitalization suffered a staggering loss of 27.31% from the beginning of the year. The stock market, reflecting the sentiments of investors worldwide amid the pandemic, has primarily mirrored a cautious approach. As a consequence, companies have now initiated cost-cutting measures, leading to layoffs and increased unemployment rates. Sectors such as travel, transportation, the entertainment industry, and oil & gas have borne the brunt of the impact, experiencing declines exceeding 40% in their stock values. Several businesses within these sectors have declared bankruptcy due to the operational standstill brought about by the lockdown. The COVID-19 pandemic had a significant impact on the National Stock Exchange (NSE) Nifty and the Bombay Stock Exchange (BSE) Sensex. In response to the economic challenges posed by the pandemic, the Indian government and the Reserve Bank of India (RBI) implemented various fiscal and monetary measures. These included stimulus packages and policy interventions aimed at stabilizing the economy and financial markets.

Coronavirus entered in the Europe in Mid-February 2020 and the first case of this virus was reported in Italy after which it continued to spread in the entire Europe at a very fast rate. European stock markets suffered a lot during the pandemic. The DAX (Germany) experienced a decline from 13,556 in 2019 to 8,742 in 2020. Similarly, the CAC 40 (France) also fell from 6,022 to 3,881 between 2019 and 2020. The FTSE MIB (Italy) index also witnessed a decrease in its value from 25,478 to 14,894 during the same period. The IBEX 35 (Spain) displayed a similar pattern, dropping from 9,803 to 6,107. Surprisingly, the situation reversed immediately after 2020, with a rapid and remarkable recovery in stock market indices throughout 2021 in all the three major economies, except for Spain while France and Germany respectively are the largest contributors of return spillovers towards other stock markets. Following the post-COVID period, notable shifts have occurred. One key observation is the rise in average total connectedness from 63.48% to 75.14%. Another noteworthy change is the unexpectedly heightened influence of Poland, where the WIG index has surpassed Spain’s IBEX 35 and Germany’s DAX, establishing itself as a major source of shocks for European stock markets, trailing only behind France and Italy in this regard. Another significant transformation evident in the post-COVID era is the diminished influence of Germany through the DAX Index. While the DAX was the second-largest contributor of return shocks after France’s CAC 40 in the pre-COVID period, it has now become the smallest net emitter in comparison to France, Italy, Spain, and Poland.

The COVID-19 pandemic had a profound impact on the stock market in the United States of America. During the initial stages of the pandemic in 2020, U.S. stock markets experienced significant volatility and sharp declines. The uncertainty surrounding the economic impact of the virus, widespread lockdowns, disruptions to supply chains, and concerns about corporate earnings contributed to this market turbulence. In response to the economic challenges posed by the pandemic, the U.S. government and the Federal Reserve implemented various fiscal and monetary measures to stabilize the economy. These measures included stimulus packages, interest rate cuts, and other support programs, which had an impact on financial markets. Pandemic disrupted the whole New York Stock Exchange (NYSE) in the early months of 2020, the NYSE, like other major stock exchanges, experienced significant declines. The benchmark indices, such as the Dow Jones Industrial Average (DJIA), S&P 500, and Nasdaq Composite, all saw substantial drops during the initial stages of the pandemic. To counter the economic fallout of the pandemic, the U.S. government and the Federal Reserve implemented stimulus measures and monetary policies to stabilize financial markets. As the pandemic progressed, financial markets globally, including the NYSE, showed signs of recovery. Vaccine developments, improving economic indicators, and ongoing government support contributed to a rebound in stock prices.

This research aimed to elucidate the impact of the COVID‐19 pandemic on the stock market dynamics of international equity indices across different markets. Other than the financial markets numerous potential directions for future research exist. The uneven impact of the COVID-19 pandemic on various sectors of the economy presents an intriguing avenue for exploration. For instance, the healthcare and technology sectors may have thrived due to pandemic-related changes in work patterns, while the transportation and tourism sectors likely faced substantial losses. Utilizing realized volatility enables a more precise intra-day analysis, particularly for markets with similar trading hours, such as the Global Financial markets where numerous countries share significant overlaps in trading hours. These areas are left for exploration in subsequent research endeavors.

References:

The Stock Market & Investment

Manh Ha DUONG German Institute for Economic Research, Königin-Luise-Straße 5,14195Berlin, Germany, Phone: +49 30 897 89 590, Fax: +49 30 897 89 102, E-mail: mduong@diw.de Boriss Siliverstovs, German Institute for Economic Research, Königin-Luise-Straße 5,14195 Berlin, Germany, Phone: +49 30 897 89 333, Fax: +49 30 897 89 102, E-mail: bsiliverstovs@diw.de

https://www.researchgate.net/publication/229025854_The_Stock_Market_and_Investmet

Integration of Indian Stock Market with the Global Market

By Janak Raj & Sarat Dhal

European equities and their volatility in comparison to the Indian Stocks

Fintech in India:Opportunities and challenges to the financial ecosystem

By Shiba Prasad Mohanty – May 9,2023

https://www.policycircle.org/governance/fintech-vs-techfin-india-2023/

Innovative Financial Instruments and Investors’ Interest in Indian Securities Markets

Published online: 18 March 2023 © The Author(s), under exclusive license to Springer Japan KK, part of Springer Nature 2023

STOCK MARKET VOLATILITY – A STUDY OF INDIAN STOCK MARKETS

Stock Market Volatility /April_2017_1492169212__150.pdf

By Sameer Yadav- Research Scholar, Department of Commerce and Business Administration, University of Allahabad, Allahabad, Uttar Pradesh.

Impact of COVID-10 on Indian Markets

By S. Ravi-a practicing chartered accountant and an independent director on many large public companies whose views and ideas have been instrumental in framing policy,Published in 2020.

https://www.businessworld.in/article/Impact-Of-COVID-19-On-The-Indian-Stock-Markets/11-05-2020-191755/

Brief History of the Stock Market

By Inyoung Hwang- June 15,2023

https://www.sofi.com/learn/content/history-of-the-stock-market/

Stock Market Development and Economic growth in India: An Empirical Analysis

P., Srinivasan Xavier Institute of Management Entrepreneurship Electronics City, Phase II, Hosur Road, Bangalore 560 100, Karnataka, India 1 May 2014

https://mpra.ub.uni-muenchen.de/55657/1/MPRA_paper_55657.pdf

Surviving Coronavirus scare: A journey of stock market amid a slowdown in Indian Economy

Sinha, Pankaj and Sawaliya, Priya and Sinha, Prateek Faculty of Management Studies, University of Delhi, National Institute of Securities Market (NISM), Mumbai 10 June 2020

https://mpra.ub.uni-muenchen.de/103902/1/MPRA_paper_103902.pdf

AN ANALYSIS OF INDIAN STOCK MARKET: PRE AND POST COVID–19

Dr. Ashish Khandelwal International Journal of Advanced Research in Commerce, Management & Social Science (IJARCMSS) 106 ISSN:2581-7930, Impact Factor: 6.809, Volume 05, No. 02(II), April-June, 2022, pp 106-111

https://www.inspirajournals.com/uploads/Issues/247403341.pdf

The outbreak of COVID‐19 pandemic and its impact on stock market volatility: Evidence from a worst‐affected economy.

Debakshi Bora and Daisy Basistha

J Public Aff. 2021 Nov; 21(4)

Published online 2021 Feb 11

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7995228/

10 Largest Stock Exchanges in the World By Market Cap – Complete List Of Stock Exchanges

by Trade Brains Nov 26, 2023 Market, Stocks https://tradebrains.in/10-largest-stock-exchanges-in-the-world/

LinkedIn Profile: Saachi Sahni